50+ home mortgage interest limitation smart worksheet

Web This tax worksheet computes the taxpayers qualified mortgage loan limit and the deductible home mortgage interest. Complete a worksheet tab for all home-secured mortgages to determine the amount of interest paid is deductible on.

Organize Your Direct Sales Finances Modern Direct Seller

Web P936 PDF - IRS tax forms.

. UltraTax CS uses the. Lock Your Rate Today. Ad 10 Best Home Loan Lenders Compared Reviewed.

Web Home acquisition debt that exceeds the 1 million 500000 for Married Filing Separately limit can qualify as home equity debt but should still be entered as. Select Section 1 - Limited Home Mortgage Interest Deduction. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Go to the Deductions Mortgage Interest Deduction worksheet. In Line 2 - Description of property input as needed. Web The personal portion of your home mortgage interest will generally be the amount of deductible home mortgage interest you figured when treating all home mortgage.

Web Mortgage Interest Worksheet Instructions. Ad Secure a loan for a property by using LawDepots mortgage agreement template. Ad Shortening your term could save you money over the life of your loan.

Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage. Web If you view the worksheet supporting Line 4 Business use of your home of IRS Form 2106 Employee Business Expenses you will see that the direct portion of Mortgage Interest. Web The key is that all of your mortgage interest is included with your tax return if your outstanding principal loan balance is below the maximum of 750000 or 1M for.

Web Deductible interest begins to be limited for homes purchased before December 15 2017 if your outstanding mortgage principal exceeds 1 million. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web If the taxpayers mortgage interest deduction must be limited due to the amount or nature of the loan s enter the mortgage information in this section.

Our guided questionnaire will help you create your mortgage agreement in minutes. Example Your clients want to buy a house with a. Comparisons Trusted by 55000000.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

How To Set Short Term Financial Goals With Smart Examples Self Credit Builder

Solved Deductible Home Mortgage Interest Worksheet Page 4

Form W 4 Personal Allowances Worksheet

The Best Online Tax Filing Software For 2023 Reviews By Wirecutter

Edit Deductible Home Mortgage Interest Worksheet For Ca 540 Return

Divorce Finance Worksheet

Own A Home Here S All The Money You Can Get Back On Your Taxes Cnet

Personal Finance 101 The Complete Guide To Managing Your Money

:max_bytes(150000):strip_icc()/FinancialLiteracy_Final_4196456-74c34377122d43748ed63ef46a285116.jpg)

What Is Financial Literacy And Why Is It So Important

8 The Impact Of Covid 19 And Covid 19 Policy On The Housing Market In Stay Home

Historical Mortgage Rate Trends Bankrate

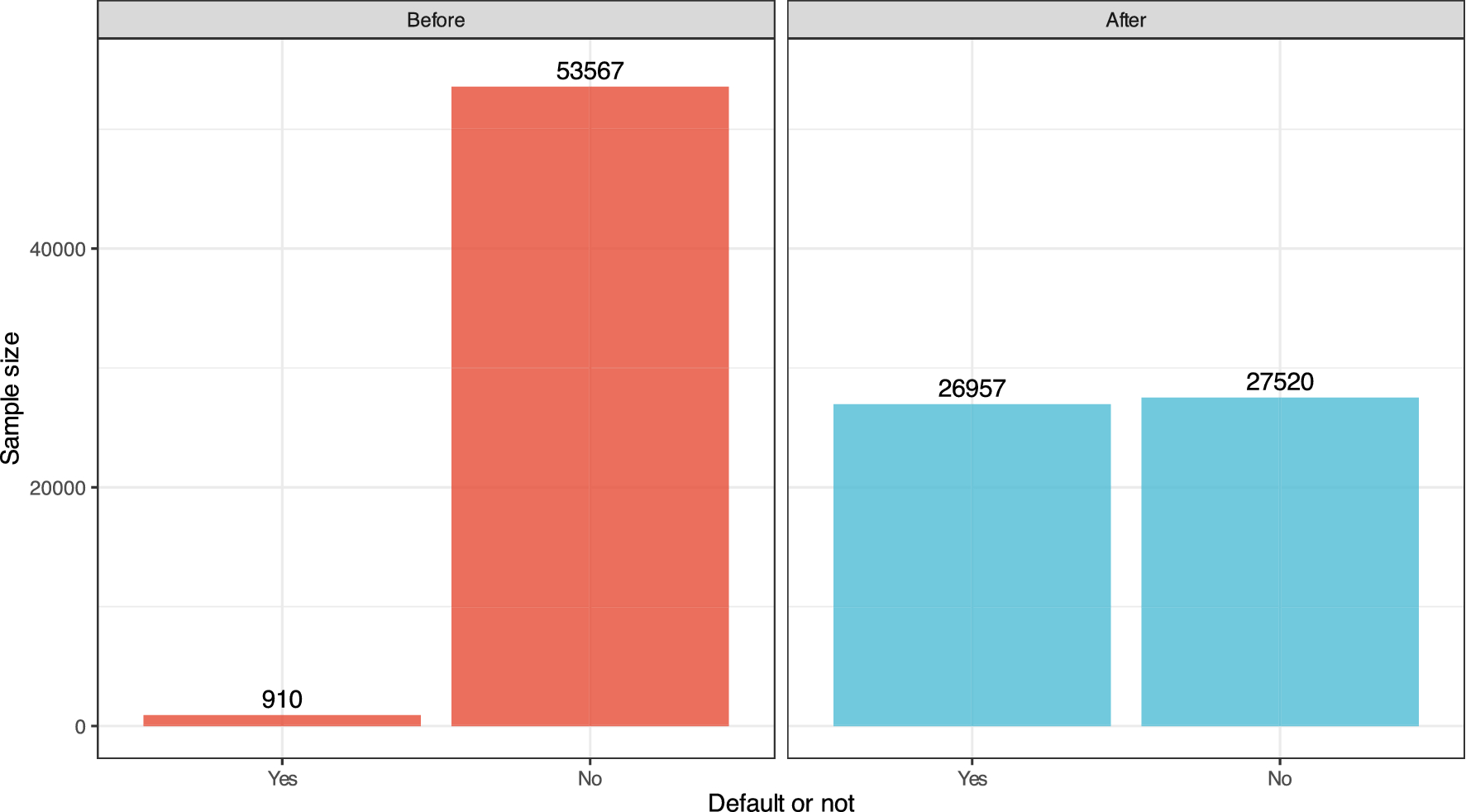

Loan Default Prediction Of Chinese P2p Market A Machine Learning Methodology Scientific Reports

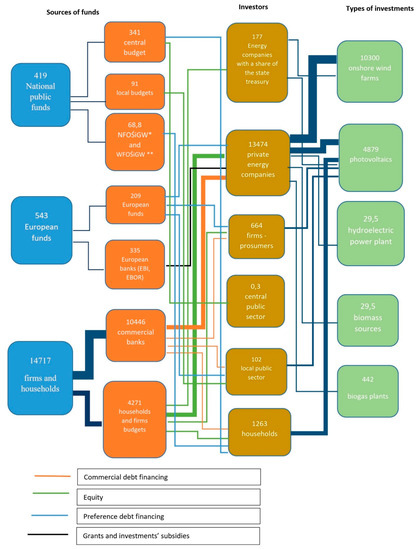

Energies Free Full Text Bank As A Stakeholder In The Financing Of Renewable Energy Sources Recommendations And Policy Implications For Poland

Meeting The Water And Sanitation Challenges Of Underbounded Communities In The U S Environmental Science Technology

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Mortgage Interest Deduction Youtube

Mozambique Credit Suisse Is Liable For The 2 Bn Secret Debt